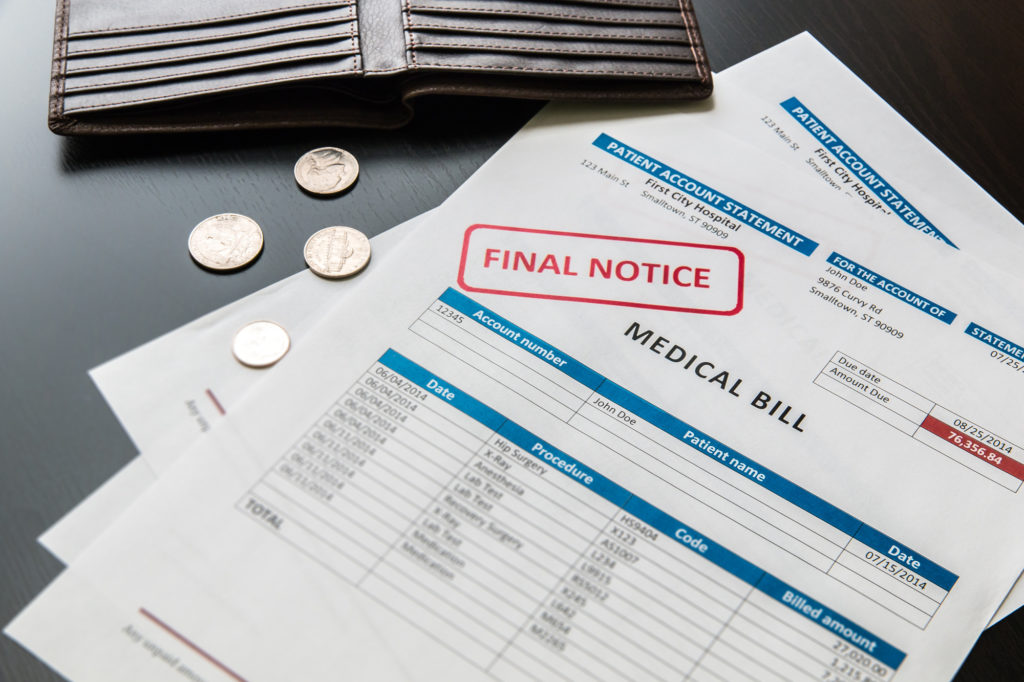

6 Tips on How to Get Medical Debt Resolution

Medical debt is hitting ordinary Americans hard. Many people cannot afford their co-pays or coinsurance. Throw in a major surgical procedure and the average person is under financial duress. The fact is over 137 million Americans are struggling with medical debt. They are responding by delaying retirement or even filing for bankruptcy. Some take on credit card […]

6 Key Strategies to Manage Your Business Loans Smoothly

Statistics from a recent Federal Reserve survey state that 43% of small businesses applied for loans in 2019 alone. It is often said that you have got to have money to make money. Taking out a business loan can provide you with the cash injection you need to boost your business to new heights. However, if business credit starts […]

5 Tools, Resources and Tips to Help You Reduce Your Student Debt

Statistics show that student debt is the highest its ever been, reaching over $1.4 trillion, with the average graduate holding over $29,000 in debt. Other findings reveal that 40% of student loan holders may default on their debt by 2023, over 3 million seniors are still paying off their student loans, and student debt is a common denominator […]

Is Debt Consolidation The Key To Financial Responsibility?

According to survey results, 59% of Americans live paycheck to paycheck. Other stats show that this number might be even higher, as much as 74%. What’s more, being stuck in a cycle of hand to mouth isn’t limited to lower-income brackets. Data from Nielsen shows that 25% of families making $150,000+ a year are completely dependant on their next paycheck […]

How To Work With Debt Collectors And Reduce Your Debt

Is your debt causing you to lose sleep at night? If you’re feeling overwhelmed by how much you owe, there are many different kinds of debt consolidation solutions you can consider. While each of these can help you get back on your feet, there might be one course of action you aren’t considering: simply contacting your creditors […]

Dealing With Debt Collectors: How Debt Consolidation Helps

In 2017 alone, 70 million Americans had to deal with debt collectors. Debt collectors also estimate contacting consumers more than 1 billion times per year. If you have any debts that are with collections, then you know how stressful and invasive dealing with debt collectors can be. Debt, in general, is shown to have negative impacts on both your mental and […]

Do You Have Too Much Debt? A Guide to Debt Resolution

According to reports, the average American has round about $38,000 in personal debt. Is this a lot? Or is it manageable? How much debt is too much? Utilizing credit and lending facilities can often add to your quality of life and your prospects. Taking out a student loan or borrowing money to start a business might be the […]

Know Your Options: What to Do When You Can’t Clear Your Medical Debt

Do you need help paying hospital bills? If so, you are not alone. Poll results from the Kaiser Family Foundation reveal that roughly a quarter of American families have had problems meeting medical bills. This is not surprising, seeing as health care in the US is more expensive than in any other country in the world. If you are facing unforeseen […]

Pay off That Debt: 7 Effective Tools and Tips to Help You

Are you up to your eyeballs in interest payments, negative account balances, and credit card bills on the counter? When you’ve accumulated too much debt, the pressure to pay can be crushing. Between credit cards, student loans, car payments and more, the average American now has $38,000 in debt, not including home mortgages. Even so, this doesn’t have to […]

Do You Need A Business Debt Consolidation Loan?

According to reports, small to medium-sized enterprises and family businesses in the US owe a total of $5.5 trillion. Business debt has been skyrocketing, reaching historically high amounts (according to the Federal Reserve), and has more than doubled since 2008. In some situations, taking out a business loan is a necessity for the health, or even the birth, […]