Pros vs. Cons of Applying for Private Student Loans: A Comparative Guide

So you just got accepted to college? Congratulations! With the flood of excitement about going to school, you’re probably also concerned about how to pay for your degree. Did you know that in 2019, the average cost of tuition fees for private universities came to over $36,000? If you or your family doesn’t have the savings […]

6 Things You Should Consider Before Applying for Business Loans

Did you know that the Burea of Labor Statistics discovered that the failure rate for small businesses across the majority of industries is 20% in their first year? Have you been contemplating applying for business loans, but aren’t sure if it’s the best decision to make for your business? If you’re looking to learn more about […]

8 Tips on Resolving U.S. Credit Card Debt

Getting into credit card debt is easy. Paying it off is another story. If you find yourself carrying more debt than you should, you aren’t alone. Dealing with monthly bills and life’s unexpected expenses make getting out of credit card debt seem like an impossible task. If you’re trying to reduce your U.S. credit card […]

What Can You Do When Paying Your Outstanding Debts is Impossible?

At first, tackling your debt seemed somewhat manageable. You eliminated discretionary spending habits, created a budget, and started prioritizing your savings account. You might have even taken on a side job to earn extra income. Now, however, you’re discovering that your outstanding debts are simply growing too high. No matter what steps you take now, you’ll be […]

What’s the Best Way to Pay Off Multiple Credit Cards?

According to reports, the average American has up to four credit cards. Juggling multiple cards can easily cause one to max out one’s limits. Which is why it’s not surprising that the average card balance has now hit $6,200. Do these numbers sound all too familiar? Are you struggling to pay off multiple cards at once? If so, it can […]

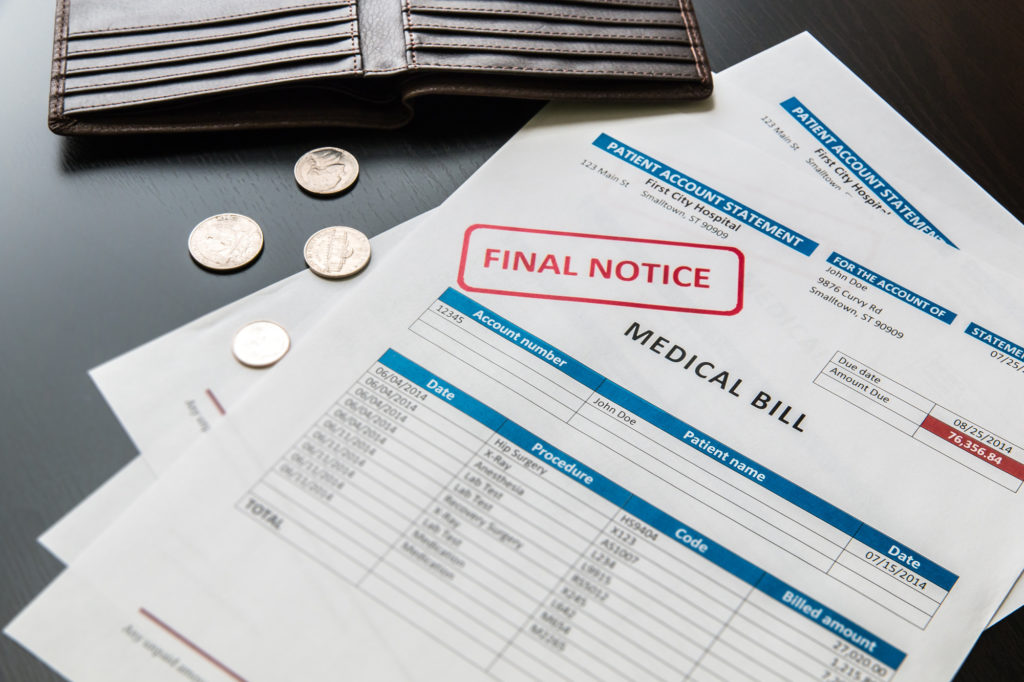

Medical Debt Help: A Complete Guide on How to Pay off Medical Bills

If you’ve ever had a medical procedure, whether it was an emergency or planned, you already know it’s expensive. The average American spends over $7,000 a year on medical services. A lot of people struggle to pay these bills back, especially if an emergency surgery occurred, and you’re in far more debt than you can afford. So […]

Go for It or Not: Should You Consolidate Student Loans?

According to research, nearly 70% of college students take out loans to fund their education. Then, they graduate with an average debt balance of around $30,000. In some regards, the myriad loan solutions available to incoming students are an invaluable resource. This financial assistance can help students pursue higher education who might have missed out on such an opportunity otherwise. […]

Yes or No: Can You Consolidate Debt Into a Home Loan?

Did you know that credit card debt in the United States crossed the $1 trillion mark in 2019? As far as total debt amounts go, Americans are officially dealing with a debt crisis. Now, there’s nothing wrong with having a credit card, per se. The actual problem with unsecured debts like credit cards is the soaring-high interest rates that come […]

How to Prepare for Debt Resolution

Has a little piece of plastic landed you in a big struggle? If you’re one of the roughly 67 million Americans who can’t pay their credit card bills this year, the answer is likely affirmative. Thankfully, there are debt resolution programs that can help. Yet, you need to know what you’re getting into, first. Before you contact […]

Need Help With Debt? 5 Resources You Can Use Today

If you think you’re alone in needing help with debt, you aren’t. Almost 300 million Americans suffer financially from debt. Fortunately for you, there are options to help you take care of the money you owe. Read on to learn about five resources available to you to help you manage your debt. Help With Debt Your […]