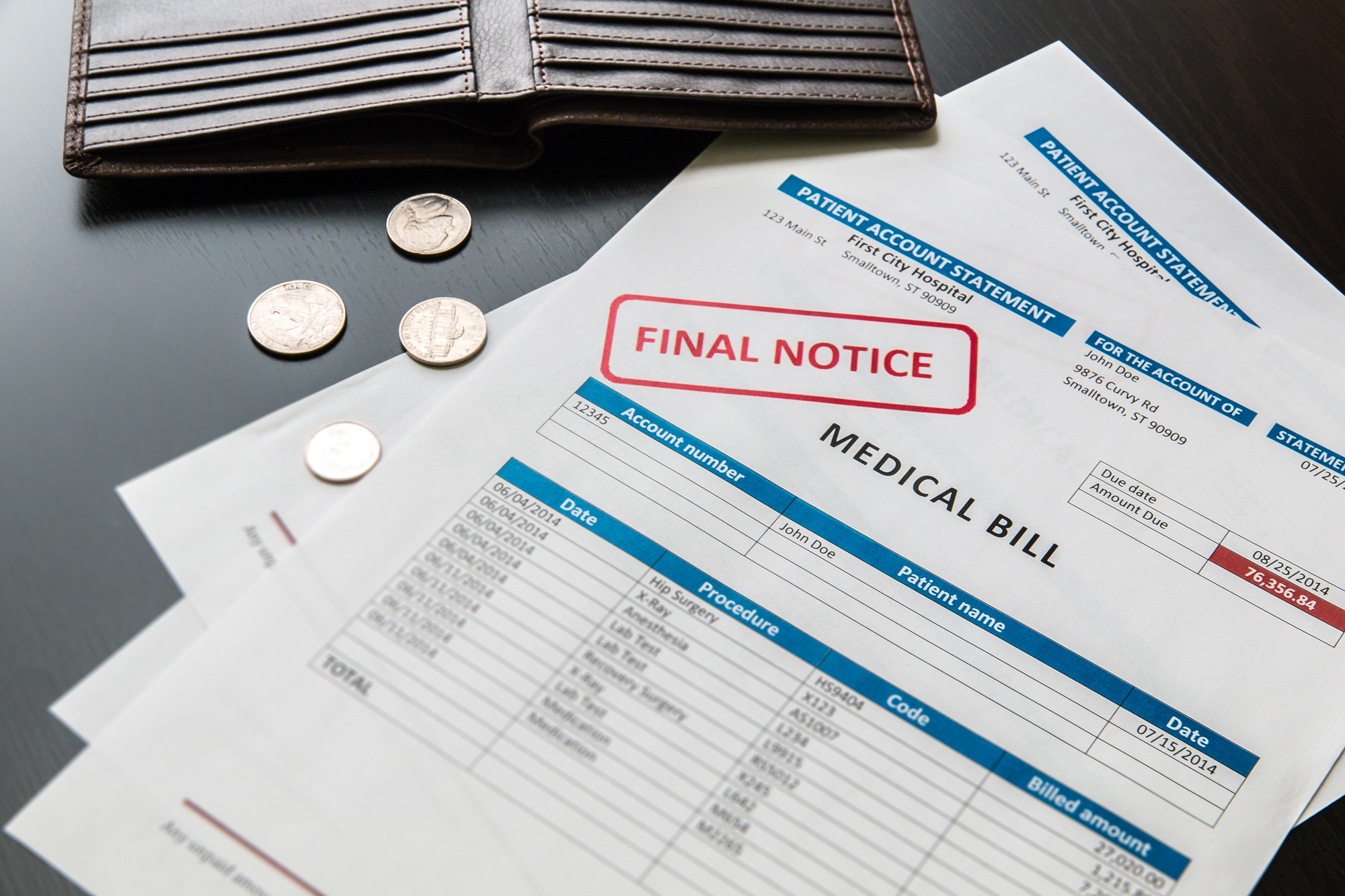

The bills were piling up and you realized that your debt obligations were getting too high to bear. So, you made a smart move and decided to pursue a debt consolidation loan. However, there’s one tiny thing getting in your way of securing the debt help you need. Actually, it’s three things: the numbers in your …